Important Notes

1) Bonus is not available for immediate withdrawal and the bonus amount and associated earnings are subject to a vesting schedule. The bonus amount and vesting rate may vary by age and state. The product is not intended to meet short-term financial goals. Products offering a bonus may offer less favorable credited interest rates, participation, and cap rates than products not offering a bonus.

2) We may change, add or eliminate indexed accounts. Dividend payments and distributions are not received from any index. While the value of each indexed account is affected by the value of an outside index, the contract does not directly participate in any stock, bond or equity investment. Enhanced Indexed Accounts include an annual strategy fee. Multi-year accounts are not available in New Hampshire. Other state variations may apply.

3) Any withdrawal (including RMDs) reverts the free withdrawal percentage back to 5% on the next contract anniversary. The free withdrawal amount excludes any non-vested premium bonus. Withdrawals exceeding the free withdrawal amount may be subject to surrender charges, recovery of non-vested premium bonus amounts, Market Value Adjustment, and pro-rated enhanced benefit fees and strategy fees (if applicable).

4) Although a 0% floor is applied, if the sum of fees exceeds the sum of interest and index credits, the contract will lose value.

Important Disclosures

For Producer Use Only. Not for distribution to the public.

Products, rider options and other features are subject to state availability. Actual product details, including all terms and conditions that apply, are contained in the annuity contract. Product sales must be appropriate based on a comprehensive evaluation of the customer’s financial situation, insurance needs, and objectives. Guarantees are based on the claims-paying ability of the issuing company. Nassau reserves the right to revise, add, or change indexed accounts and declared rates at any time.

Nassau, its affiliated companies, and employees do not give fiduciary, legal or tax advice.

Selected Risk Considerations for the Smart Passage SG Index:

The Smart Passage SG Index (the “Index”) is the exclusive property of SG Americas Securities, LLC (SG Americas Securities, LLC, together with its affiliates, “SG”). SG has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) (“S&P”) to maintain and calculate the Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, and “Smart Passage SG Index” (collectively, the “SG Marks”) are trademarks or service marks of SG. SG has licensed use of the SG Marks to Nassau Life and Annuity Company (“NLA”) for use in a fixed indexed annuity offered by NLA (the “Fixed Indexed Annuity”). SG’s sole contractual relationship with NLA is to license the Index and the SG Marks to NLA. None of SG, S&P or other third party licensor (collectively, the “Index Parties”)to SG is acting, or has been authorized to act, as an agent of NLA or has in any way sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Fixed Indexed Annuity or provided investment advice to NLA.

No Index Party has passed on the legality or suitability of, or the accuracy or adequacy of the descriptions and disclosures relating to, the Fixed Indexed Annuity, including those disclosures with respect to the Index. The Index Parties make no representation whatsoever, whether express or implied, as to the advisability of purchasing, selling or holding any product linked to the Index, including the Fixed Indexed Annuity, or the ability of the Index to selling or holding any product linked to the Index, including the Fixed Indexed Annuity, or the ability of the Index to meet its stated objectives, including meeting its target volatility. The Index Parties have no obligation to, and will not, take the needs of NLA or any annuitant into consideration in determining, composing or calculating the Index. The selection of the Index as a crediting option under a Fixed Indexed Annuity does not obligate NLA or SG to invest annuity payments in the components of the Index.

THE INDEX PARTIES MAKE NO REPRESENTATION OR WARRANTY WHATSOEVER, WHETHER EXPRESS OR IMPLIED, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, THOSE OF MERCHANT ABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE), WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN OR RELATING THERETO, AND IN PARTICULAR DISCLAIM ANY GUARANTEE OR WARRANTY EITHER AS TO THE QUALITY, ACCURACY, TIMELINESS AND/OR COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN, THE RESULTS OBTAINED FROM THE USE OF THE INDEX AND/OR THE CALCULATION OR COMPOSITION OF THE INDEX, OR CALCULATIONS MADE WITH RESPECT TO ANY FIXED INDEXED ANNUITY AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE OR OTHERWISE. THE INDEX PARTIES SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR OR OMISSION IN THE INDEX OR IN THE CALCULATION OF THE INDEX, AND THE INDEX PARTIES ARE UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN, OR FOR ANY INTERRUPTION IN THE CALCULATION OF THE INDEX. NO INDEX PARTY SHALL HAVE ANY LIABILITY TO ANY PARTY FOR ANY ACT OR FAILURE TO ACT BY THE INDEX PARTIES IN CONNECTION WITH THE DETERMINATION, ADJUSTMENT OR MAINTENANCE OF THE INDEX. WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL AN INDEX PARTY HAVE ANY LIABILITY FOR ANY DIRECT DAMAGES, LOST PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

No Index Party is a fiduciary or agent of any purchaser, seller or holder of a Fixed Indexed Annuity. None of SG, S&P or any third party licensor shall have any liability with respect to the Fixed Indexed Annuity in which an interest crediting option is based is on the Index, nor for any loss relating to the Fixed Indexed Annuity, whether arising directly or indirectly from the use of the Index, its methodology, any SG Mark or otherwise. Obligations to make payments under the Fixed Indexed Annuities are solely the obligation of NLA. In calculating the performance of the Index, SG deducts a maintenance fee of 0.50% per annum on the level of the Index, and fixed transaction and replication costs, each calculated and deducted on a daily basis. Because the Index can experience potential leverage up to 350%, the maintenance fee may be as high as 1.75% per year. The transaction and replication costs cover, among other things, rebalancing and replication costs. The total amount of transaction and replication costs is not predictable and will depend on a number of factors, including the performance of the index underlying the Index, and market conditions, among other factors. These fees and costs will reduce the potential positive change in the Index and increase the potential negative change in the Index. While the volatility control applied by the Index may result in less fluctuation in rates of return as compared to indices without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls.

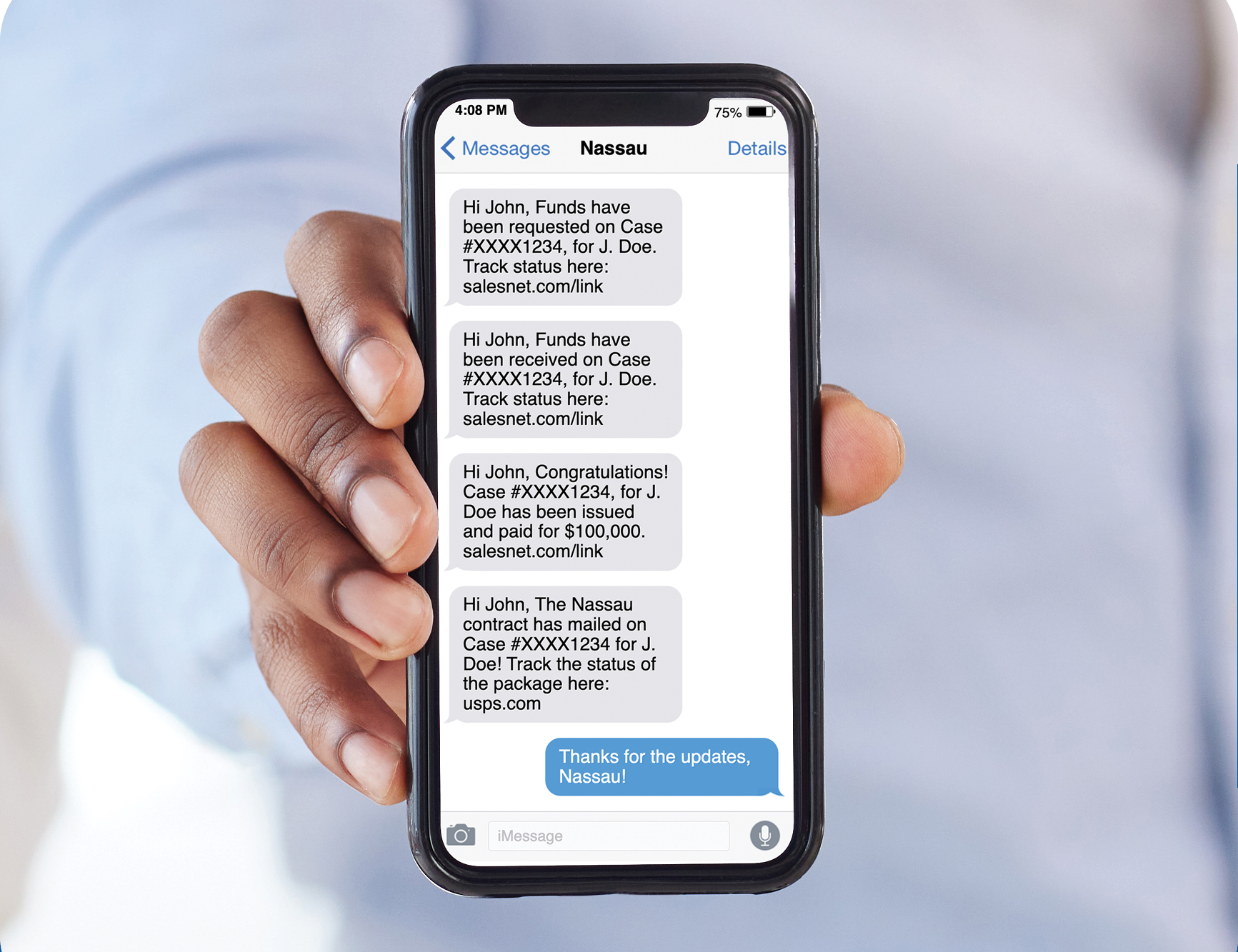

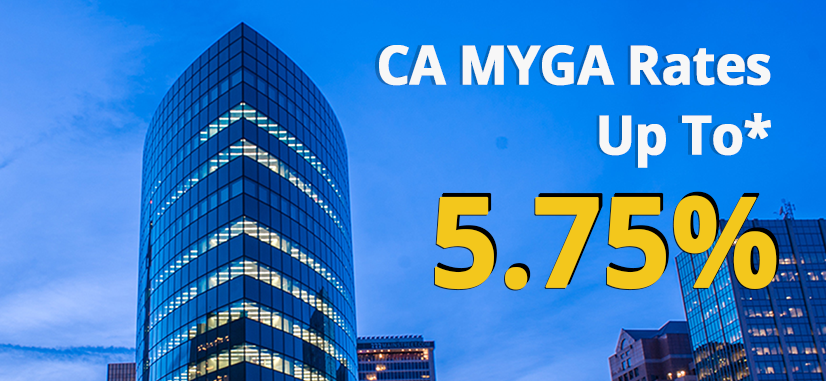

Nassau Bonus Annuity Plus (23FIA4, ICC23FIA4) is issued by Nassau Life and Annuity Company (Hartford, CT). In California, Nassau Life and Annuity Company does business as “Nassau Life and Annuity Insurance Company.” Nassau Life and Annuity Company is not authorized to conduct business in ME and NY, but that is subject to change. Nassau Life and Annuity Company is a subsidiary of Nassau Financial Group.

BPD41963

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee.

NASSAU SALES NEWS

NASSAU SALES NEWS

Recent Comments