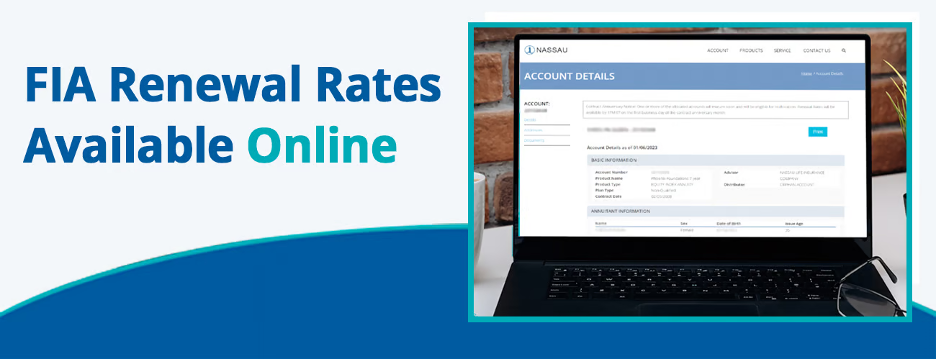

Change to Renewal Rate Letters Coming in February

Renewal rates will now be available online and no longer included in client and agent letters. Renewal letters will continue to be mailed at least 30 days prior to anniversary dates and include the instructions for accessing rates on nfg.com. Rates will display on the first business day of a contract’s anniversary month. There is no change to the reallocation form or deadline of 15 days after anniversary date to request changes.

The new version of letters will begin in February for March anniversaries.

Easy 24/7 Online Account Access

- Agents can register/log in to salesnet.nfg.com and select TRACK | Account Values | Search for Policy | Select Policy Number | Open Renewal Rates link at top of Account Details

- Clients can register/log in under MYACCOUNT on nfg.com. From MY PORTFOLIO | Select Policy Number | Open Renewal Rates link at top of Account Details

This is the first of future enhancements to move the renewal rates process more online. We look forward to sharing more in the coming year.

If you have any questions, please contact our web account team at 1-800-349-9267.

Important Disclosures

For Producer Use Only. Not for distribution to the public.

Products, rider options and other features are subject to state availability. Actual product details, including all terms and conditions that apply, are contained in the annuity contract. Annuity contract sales must be appropriate based on a comprehensive evaluation of the customer’s financial situation, insurance needs, and objectives. Guarantees are based on the claims-paying ability of the issuing company.

Nassau, its affiliated companies, and employees do not give fiduciary, legal or tax advice.

Nassau Annuities are issued by Nassau Life and Annuity Company (Hartford, CT), except in New York where annuities are issued by Nassau Life Insurance Company (East Greenbush, NY). In California, Nassau Life and Annuity Company does business as “Nassau Life and Annuity Insurance Company.” Nassau Life and Annuity Company is not authorized to conduct business in ME and NY, but that is subject to change. Nassau Life and Annuity Company and Nassau Life Insurance Company are subsidiaries of Nassau Financial Group. The insurers are separate entities and each is responsible only for its own financial condition and contractual obligations.

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee.

BPD41273

NASSAU SALES NEWS

NASSAU SALES NEWS

Recent Comments