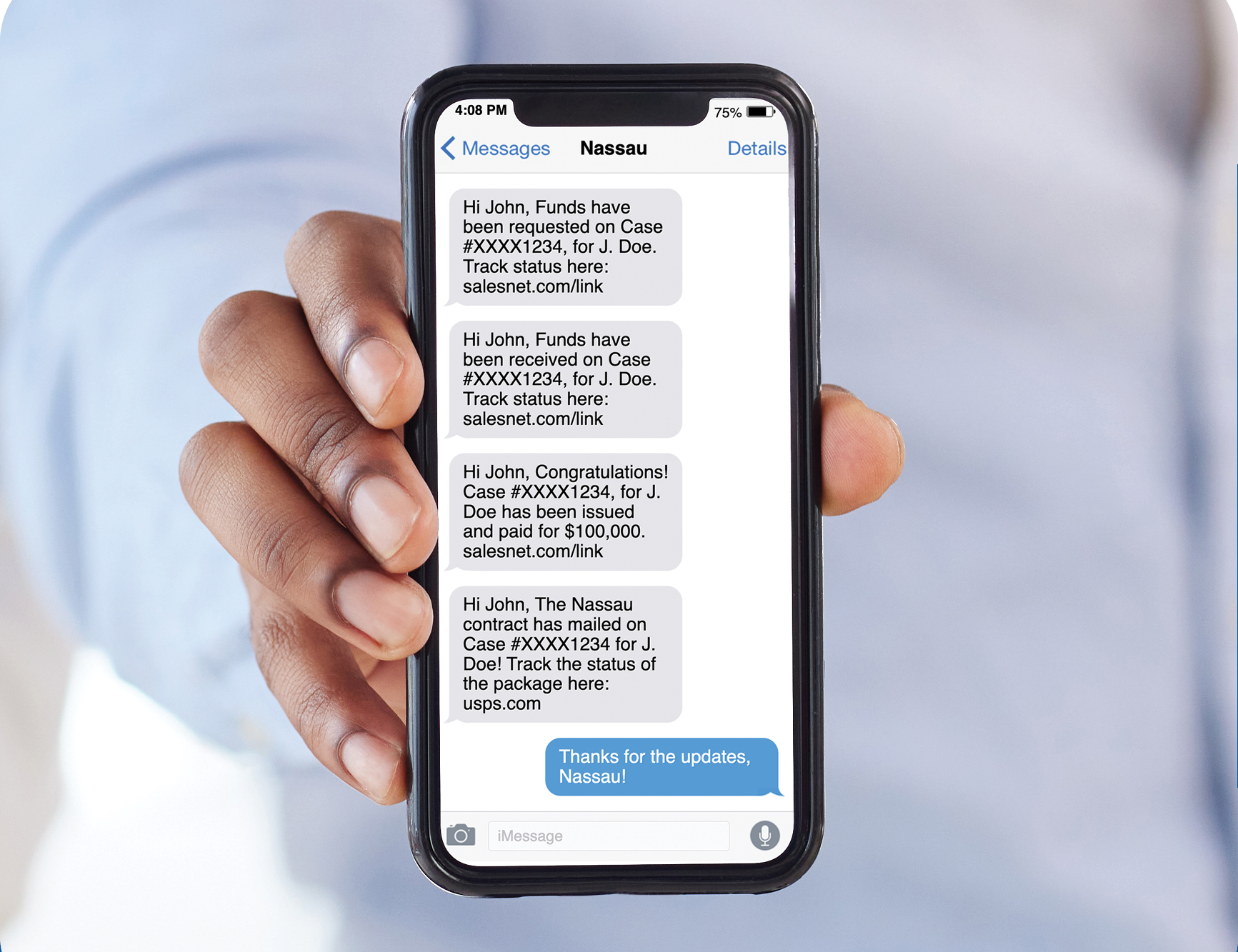

Enjoy Less Follow Up and Faster Processing

We are thrilled to announce an exciting enhancement to Nassau’s eApp designed to streamline your new business experience. Beginning June 17th, Nassau’s Med Supp eApp will be able to instantly verify a producer’s contracting and state appointment(s). This integration means you will know sooner about missing requirements, reducing delays in processing after submission. These improvements are made possible by entering your National Producer Number (NPN), which has been a required field since May.

We are excited to introduce these updates that are designed to allow you to submit with ease of mind and streamline your experience. Here are other benefits and highlights you should know:

-

More In Good Order Apps

This update replaces the manual check for contracting and licensing requirements during ‘First Review’ with an automated validation that ensures in good order producer requirements at submission or provides quick notice of any missing items, as needed.

-

NPN Required

Your NPN enables the automated validations and will also tie to auto populate your Nassau Producer Code in the app. Check Firelight for quick steps on how to update and save your NPN in your account Preferences and pre-fill the required field.

-

No Hard Stops

Submissions are allowed with open requirements and you are informed upfront on any actions you’ll need to take to satisfy producer-related requirements (Exception only for PA, which requires pre-appointment).

-

New Producers Get Nassau Code Upfront

Nassau Producer Codes will be auto assigned with first eApp submission – speeding up the start of just in time contracting for new producers.

-

Note

Your Nassau Producer Code remains an important unique identifier and may still be asked for when contacting our New Business, Contracting or Service areas.

Nassau is committed to providing you with the best tools and resources to support your success and strives to continually improve our New Business experience and processes. We know that your time is valuable, and these improvements should make doing business with us more efficient. It’s just one of the many ways we are working harder to be your carrier of choice.

Please call our New Business Team at 800-417-4769 for questions.

Visit SalesNet to learn more or submit an eApp.

Disclosures

For IMO/Producer Use Only. Not for distribution to the public.

Nassau Medicare Supplement insurance policies are insured by Nassau Life Insurance Company of Kansas, a subsidiary of Nassau Financial Group. Product availability varies by location and plan type and is subject to change. BPD41764

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee

NASSAU SALES NEWS

NASSAU SALES NEWS

Recent Comments