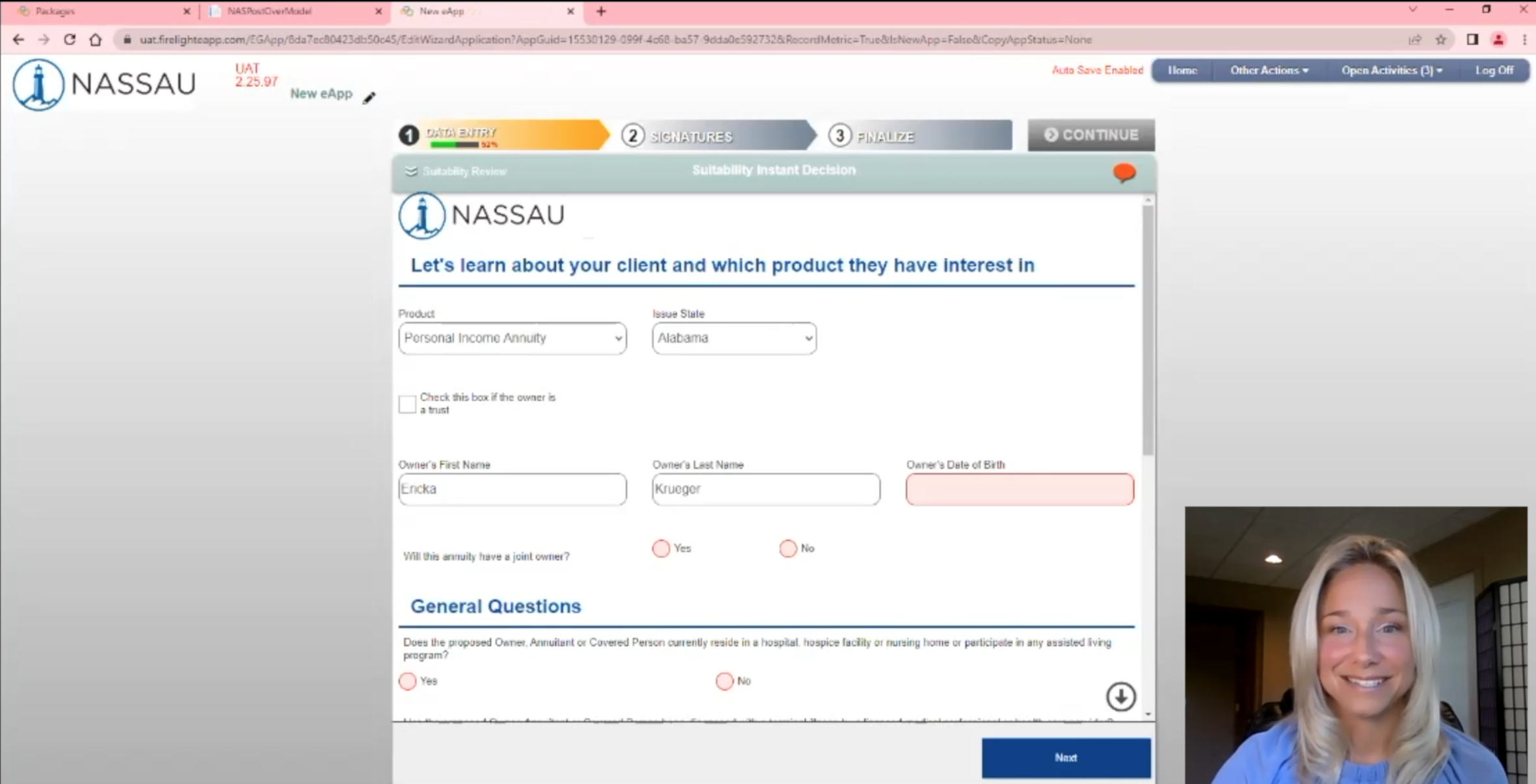

At Nassau, we strive to make your experience submitting new business with us as easy and efficient as possible. This September 30, we will launch a series of digital enhancements to help you submit your business, your way—including enhancements to our eApp.

Watch Ericka Krueger, business systems analyst, review eApp enhancements.

Sleek, Modern Design

eApp will look and feel more like the online forms you fill out in your daily life.

Disclosures

For Producer Use Only. Not for use in solicitation or advertising to the Public.

Product features, rider options and availability may vary by state. Actual product details, including all terms and conditions that apply, are contained in the annuity contract. Product sales must be appropriate based on a comprehensive evaluation of the customer’s financial situation, needs, and objectives. Lifetime payments and guarantees are based on the claims-paying ability of the issuing company.

Nassau Annuities are issued by Nassau Life and Annuity Company (Hartford, CT). In California, Nassau Life and Annuity Company does business as “Nassau Life and Annuity Insurance Company.” Nassau Life and Annuity Company is not authorized to conduct business in MA, ME and NY, but that is subject to change. In New York, Nassau MYAnnuity 5X (Form17IMGA) single premium deferred fixed annuities are issued by Nassau Life Insurance Company (East Greenbush, NY). Nassau Life and Annuity Company and Nassau Life Insurance Company are subsidiaries of Nassau Financial Group. The insurers are separate entities and each is responsible only for its own financial condition and contractual obligations.

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee

BPD#41089

© 2022 Nassau

NASSAU SALES NEWS

NASSAU SALES NEWS

Recent Comments